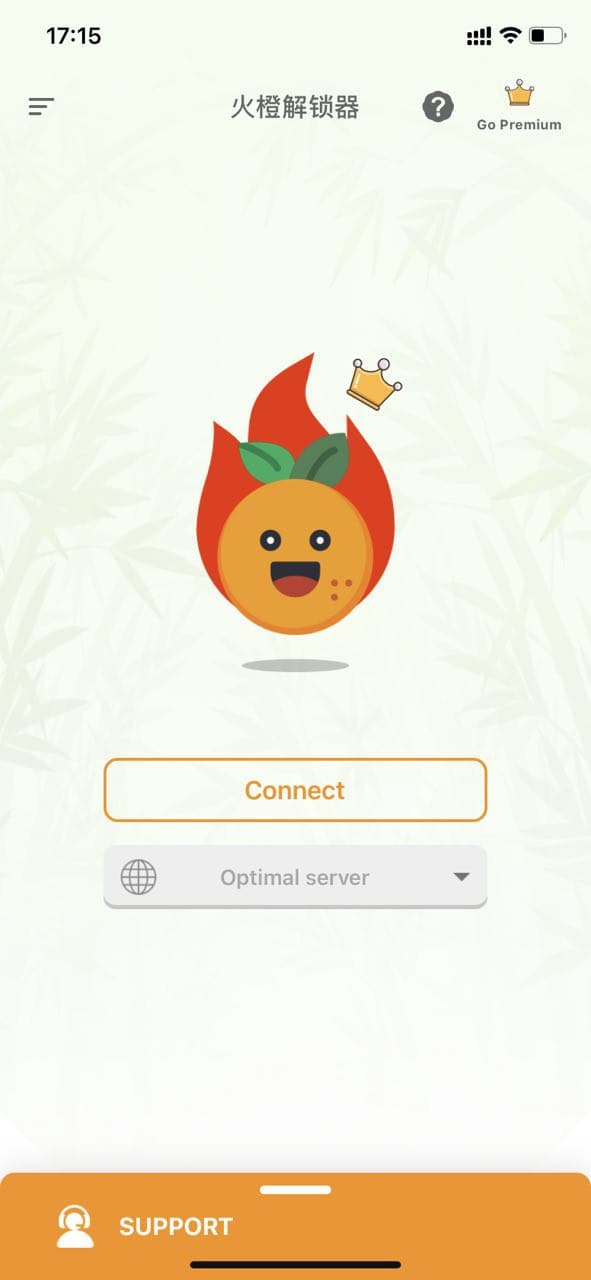

智能AI连接,只需三秒

快连采用了全新内核,智能AI连接,自动选择最优线路,不 论您在哪里,按下软件开启按钮后只需轻轻等待,3~2~1, 即可连接成功,体验丝滑般的享受。

科学上网,没有任何限制

通过快连您可以访问国内外任何角落,任何内容, 我们使用各种技术绕过互联网审查和防火墙, 所以您完全不用担心您的隐私安全和访问记录。全球服务器部署,稳定快捷

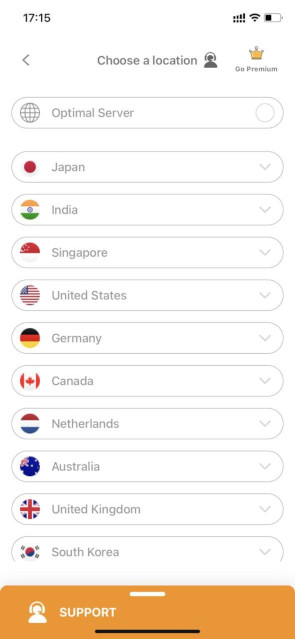

快连内置多个国家的线路选择,每个国家又部署了不同的服务器, 基于全球的服务器网络,连接速度及稳定有充分保障,无限带宽, 无任何网络节流。

用户评价

我用了2年了,手游端游主机都有用,还可以,性价比真高的了

这个快橙是真心好,我手机较差每次玩吃鸡都会有点小卡,我用了这个火橙后玩吃鸡更流畅了,强烈推荐

是不是钓鱼的回答,不管了,快橙就是鱼,愿者上钩!

我们雷快橙,常年做活动,,可以买一次使用一年,非常的随心所欲,注册就送体验时长

我们雷快橙,常年做活动,,可以买一次使用一年,非常的随心所欲,注册就送体验时长

之前一直是别的解锁器,最近刚试了试快橙,感觉火橙的要稍微好一点,总体大差不差吧。快橙真的便宜啊

能满足这条件的,我只能把路指向快橙。一语道破,不是所有解锁器都能加速外服手游,国外网站、也不是所有解锁器都能白嫖。很难得,快橙,都可以!

快橙,我玩外服都是用这个,延迟低不掉线,玩游戏和看网飞挺流畅的

立即免费试用

登录账户

登录账户

版下载

版下载 安卓版下载

安卓版下载